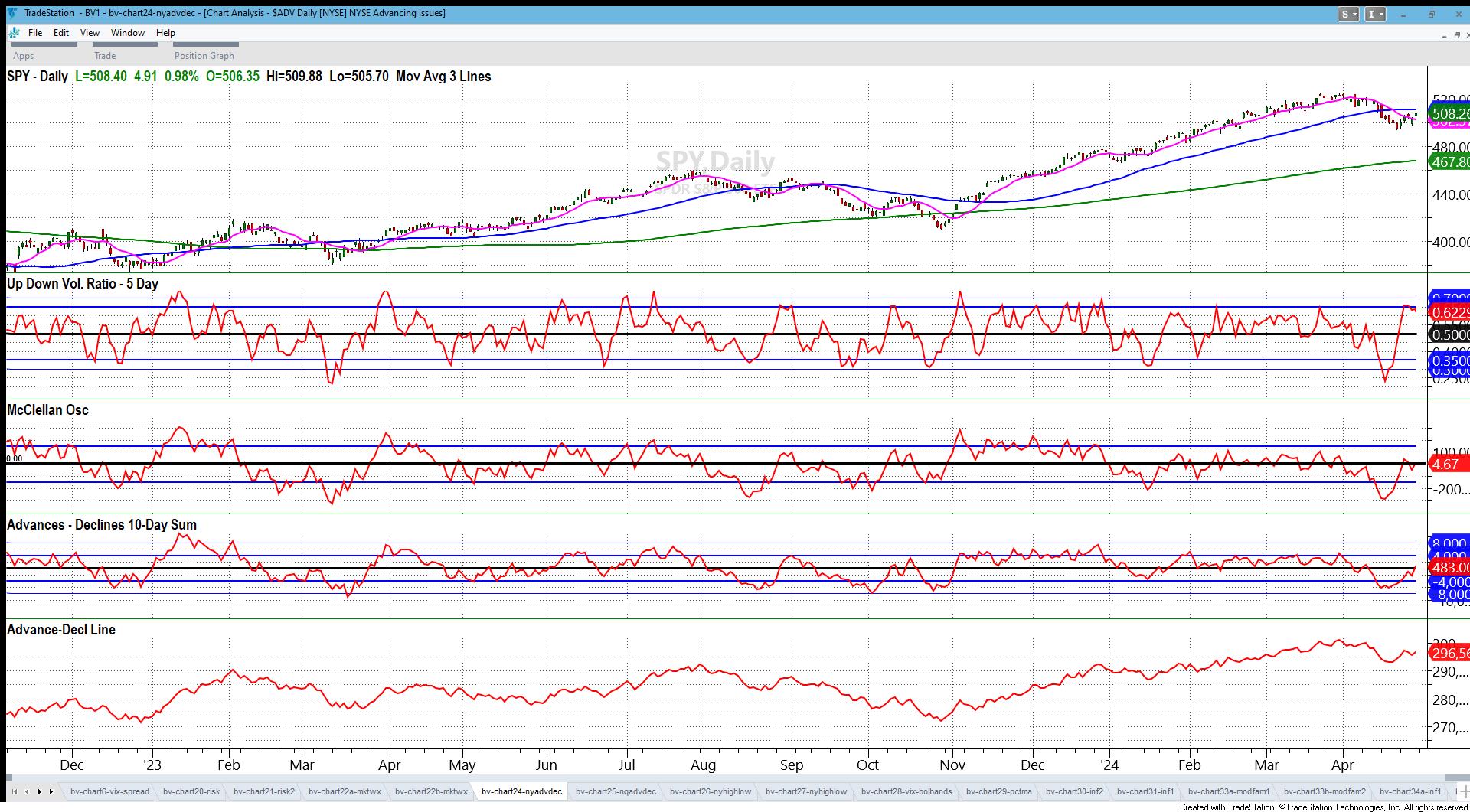

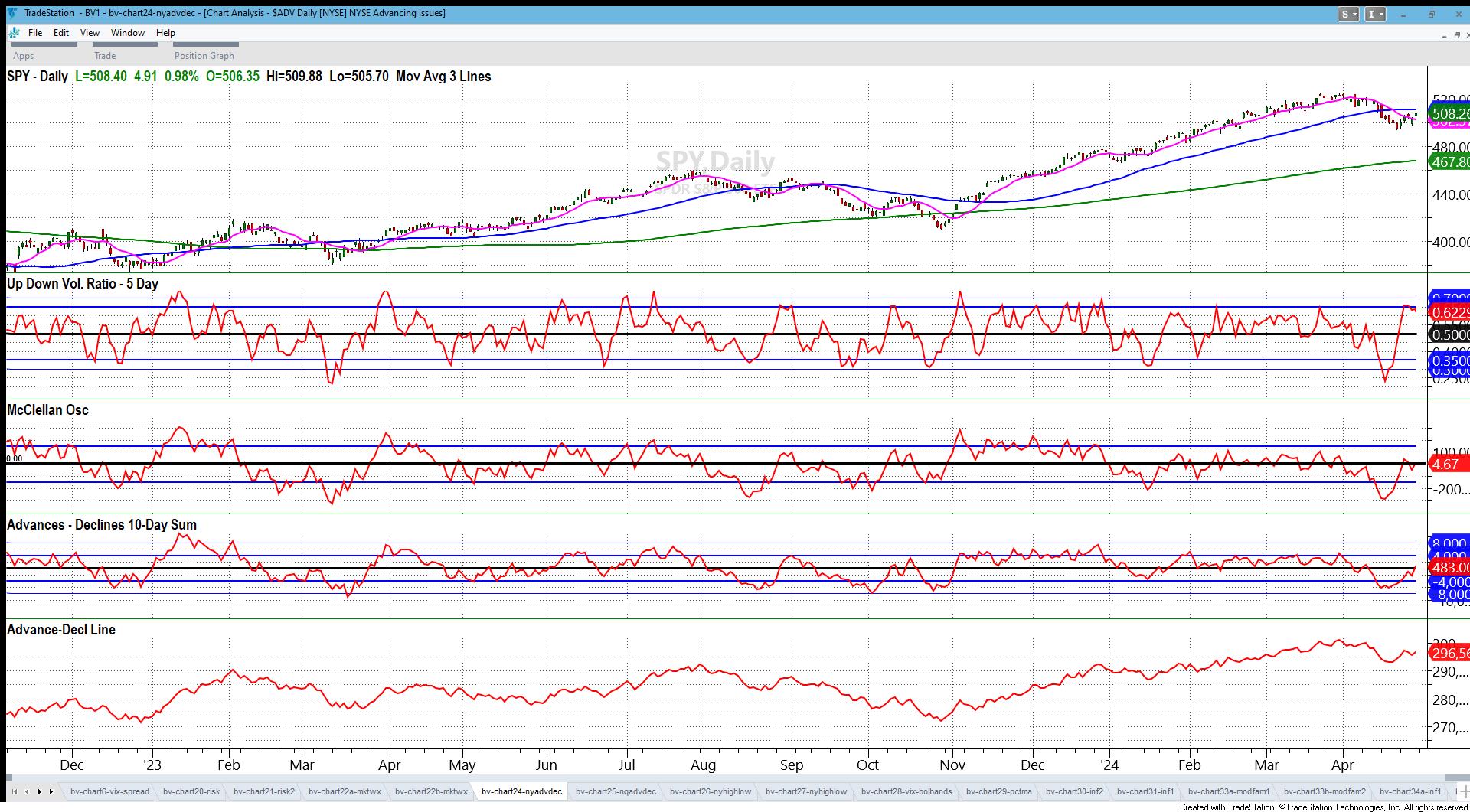

Chart Last Updated: April 18 2024

To see key chart levels click here.

Category: Internals

Description:

This chart tracks 3 different ways to look at market breadth: how many stocks advanced vs. declined in a given day, how many over a 10 day period, and the total volume in stocks that advanced vs. stocks that declined for the day.

All three indicators offer a different measure the internal strength of the market and when it becomes too overbought or oversold. When all three indicators are in a similar state, it can be seen as clearer or stronger signal.

How to use the "Up Down Volume Ratio - 5 Day":

The first indicator on the chart is the "Up Down Volume Ratio - 5 Day" which displays a 5-day average of the ratio of advancing volume to the sum of declining volume. This is a measure of overbought and oversold conditions. When the ratio reaches an extreme and reverses, the market has a tendency to also reverse or consolidate.

The formula is: 5-day average of (up volume) / (up volume + down volume))

The chart has two levels of overbought and oversold. The bold blue horizontal lines at 0.65 and 0.35 represent common overbought and oversold levels. More extreme levels are indicated by the thin blue line at the 0.70 and 0.30 levels.

How to use the "McClellan Oscillator":

The second indicator on the chart is the McClellan Oscillator and it measures the average number of advancing vs. declining stocks over the last 19 days vs the same average over 39 days.

The formula is:

(19-day EMA of (advances - declines)) - (39-day EMA of (advances - declines))

EMA= Exponential Moving Average

It is considered bullish when it is over zero, and bearish when it is below zero. It is also a good overbought and oversold indicator when it reaches extremes and then reverses. The common levels of overbought or oversold are 150 and -150. More extreme levels are 250 and -250.

It is best not to anticipate a market turn based on this indicator being at an extreme until the indicator actually turns.

How to use the "Advances-Declines 10-Day Sum":

The third indicator on the chart is a different view of the extent to which the number of advancing issues is outpacing declining issues or vice versa over a 10-day period.

The formula is: (total advances over the last 10 days) - (total advances over the last 10 days + total declines over the last 10 days)

This is another overbought and oversold indicator with two levels indicated as extremes. The common level is 4,000 and -4,000. The more extreme levels are 8,000 and -8,000.